Title: Understanding Quantitative Momentum (QMom) Programming

Quantitative Momentum (QMom) programming is a powerful approach in quantitative finance that aims to exploit the momentum effect in financial markets. It involves systematic strategies driven by mathematical models to identify and capitalize on trends in asset prices. Let's delve into the key concepts, strategies, and programming aspects of Quantitative Momentum.

Understanding Momentum Investing:

Momentum investing is grounded in the observation that assets that have performed well in the past tend to continue performing well in the future, while poorly performing assets continue to underperform. This phenomenon contradicts the efficient market hypothesis and forms the basis for momentum strategies.

Key Components of Quantitative Momentum:

1.

Selection Universe

: QMom strategies typically start with a large universe of assets such as stocks, ETFs, or futures contracts.2.

Momentum Calculation

: Momentum is calculated based on historical returns over a specified period, often ranging from a few months to a year. Commonly used indicators include relative strength and price rate of change.3.

Ranking Assets

: Assets are ranked based on their momentum scores, with higher scores indicating stronger momentum.4.

Portfolio Construction

: A portfolio is constructed by selecting assets with the highest momentum scores while applying constraints such as diversification, liquidity, and risk management.5.

Rebalancing

: Periodic rebalancing ensures that the portfolio remains aligned with current market conditions and the momentum factor.Strategies in Quantitative Momentum Programming:

1.

CrossSectional Momentum

: This strategy compares assets within the same universe and selects those with the highest relative momentum.2.

TimeSeries Momentum

: Also known as trendfollowing, this strategy exploits the persistence of trends in asset prices over time.3.

FactorBased Momentum

: Integrates momentum with other factors such as value, quality, or volatility to enhance riskadjusted returns.4.

Sector Rotation

: Rotates among different sectors based on their relative momentum, capitalizing on sectorlevel trends.Programming Considerations:

1.

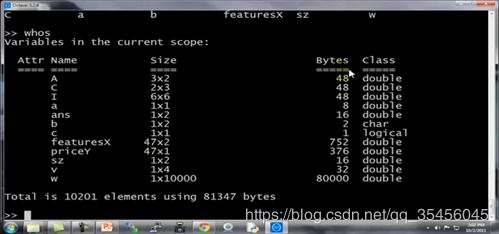

Data Acquisition

: Accessing highquality financial data is crucial for backtesting and implementing QMom strategies. This may involve historical price data, fundamental data, and macroeconomic indicators.2.

Momentum Calculation

: Implementing momentum calculations requires timeseries analysis skills. Libraries such as Pandas in Python provide efficient tools for data manipulation and calculation.3.

Portfolio Optimization

: Efficient portfolio construction and optimization techniques are essential for maximizing riskadjusted returns. Libraries like SciPy or specialized finance libraries offer optimization functions.4.

Backtesting

: Rigorous backtesting is necessary to evaluate the performance of QMom strategies under various market conditions. Platforms like QuantConnect or Quantopian facilitate backtesting and simulation of trading strategies.5.

Risk Management

: Incorporating risk management rules, such as stoploss mechanisms or position sizing based on volatility, is vital for controlling downside risk.Best Practices and Challenges:

1.

Diversification

: Avoid overconcentration in a few assets to mitigate idiosyncratic risk. Diversifying across different asset classes and sectors enhances portfolio robustness.2.

Transaction Costs

: High turnover in momentum strategies can lead to increased transaction costs. Minimizing trading frequency or optimizing execution strategies helps mitigate this challenge.3.

Market Regimes

: Momentum strategies may underperform during certain market regimes, such as trend reversals or sudden volatility spikes. Adaptive strategies that adjust to changing market conditions can be more resilient.4.

Psychological Bias

: Investors may succumb to behavioral biases such as chasing past winners or selling during downturns. Implementing systematic rules helps mitigate emotional decisionmaking.

Conclusion:

Quantitative Momentum programming offers a systematic approach to capturing momentum effects in financial markets. By leveraging mathematical models and programming skills, investors can design robust strategies to exploit momentum opportunities while managing risks effectively. Understanding the key concepts, strategies, and programming considerations is essential for successfully implementing QMom strategies and achieving longterm investment objectives.

References:

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance, 48(1), 6591.

Moskowitz, T. J., Ooi, Y. H., & Pedersen, L. H. (2012). Time series momentum. Journal of Financial Economics, 104(2), 228250.

Asness, C. S., Moskowitz, T. J., & Pedersen, L. H. (2013). Value and momentum everywhere. The Journal of Finance, 68(3), 929985.

评论