etf套利门槛

Title: Understanding ETF Arbitrage and its Programming Implementation

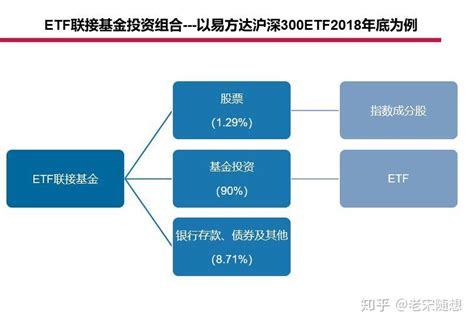

ETFs, or ExchangeTraded Funds, have gained significant popularity in the investment world due to their diversified nature and ease of trading on stock exchanges. ETF arbitrage is a strategy used by traders to exploit price discrepancies between the ETF's market price and its net asset value (NAV). Let's delve into the concept of ETF arbitrage and explore how it can be implemented through programming.

Understanding ETF Arbitrage:

ETFs are designed to track the performance of a specific index, commodity, bond, or a basket of assets. The market price of an ETF is determined by supply and demand dynamics in the stock market. However, the ETF's NAV represents the total value of its underlying assets divided by the number of outstanding shares. In theory, the market price of an ETF should closely mirror its NAV. But in reality, various factors such as trading imbalances, liquidity constraints, and market inefficiencies can cause deviations between the two prices.

ETF arbitrageurs capitalize on these deviations by buying or selling the underlying securities of the ETF and the ETF shares themselves to profit from the price differences. The arbitrage process involves several steps:

1.

Identifying Price Discrepancies:

Arbitrageurs continuously monitor the ETF's market price and its NAV to identify any deviations.2.

Calculating Deviations:

Analyzing the magnitude and direction of the deviation between the market price and NAV to determine the potential profit opportunity.3.

Executing Trades:

Buying or selling the ETF shares and its underlying securities to capitalize on the price differential.4.

Arbitrageurs' Role:

Their trading activity helps to bring the market price of the ETF back in line with its NAV, contributing to the overall market efficiency.Programming ETF Arbitrage:

Implementing ETF arbitrage through programming involves automating the process of monitoring price differentials, analyzing data, and executing trades. Here's how you can approach it:

1.

Data Collection:

Utilize financial data APIs or web scraping techniques to gather realtime or delayed data on ETF prices and NAVs.

Store the collected data in a structured format for analysis.

2.

Price Deviation Calculation:

Develop algorithms to calculate deviations between the market price and NAV of the ETF.

Consider factors such as transaction costs, bidask spreads, and trading volume in your calculations.

3.

Decision Making:

Implement decisionmaking logic based on predefined criteria for initiating arbitrage trades.

Criteria may include threshold deviations, risk management parameters, and market conditions.

4.

Trade Execution:

Integrate with brokerage APIs or trading platforms to execute buy or sell orders for the ETF shares and underlying securities.

Implement order management systems to handle trade execution efficiently.

5.

Risk Management:

Incorporate risk management strategies to mitigate potential losses, such as position sizing, stoploss orders, and portfolio diversification.

6.

Backtesting and Optimization:

Conduct backtesting using historical data to evaluate the effectiveness of your arbitrage strategy.

Optimize parameters and algorithms based on backtesting results to improve performance.

7.

Monitoring and Maintenance:

Develop monitoring tools to track the performance of the arbitrage strategy in realtime.

Regularly review and update the system to adapt to changing market conditions and optimize performance.

Conclusion:

ETF arbitrage presents an opportunity for traders to profit from inefficiencies in the market by exploiting price divergences between an ETF's market price and its NAV. By leveraging programming techniques, traders can automate the arbitrage process, enabling faster decisionmaking and trade execution. However, it's essential to consider the complexities of market dynamics and implement robust risk management practices to succeed in ETF arbitrage trading.

评论