预算的英文有哪些

Title: Budgeting Advice

Budgeting is a fundamental aspect of financial management, crucial for individuals, families, and businesses alike. Whether you're managing personal finances or overseeing the budget of a large corporation, effective budgeting can help you allocate resources wisely, achieve your financial goals, and weather economic uncertainties. In this guide, we'll delve into budgeting advice tailored to various contexts, offering practical tips and strategies to optimize your financial planning.

Personal Budgeting:

1. Assess Your Income and Expenses:

Start by calculating your total monthly income from all sources.

Next, track your expenses meticulously for a month to understand your spending patterns accurately.

2. Set Clear Financial Goals:

Define shortterm and longterm financial objectives, such as saving for emergencies, paying off debt, or investing for retirement.

Prioritize your goals based on urgency and importance.

3. Create a Realistic Budget:

Allocate your income towards essential expenses like housing, utilities, groceries, and transportation.

Set aside a portion for discretionary spending on nonessential items like entertainment and dining out.

Remember to allocate funds for savings and debt repayment.

4. Monitor and Adjust Regularly:

Review your budget periodically to track your progress and identify areas for improvement.

Adjust your budget as needed to accommodate changes in income, expenses, or financial goals.

Business Budgeting:

1. Understand Your Revenue Streams:

Analyze your sources of revenue and their reliability.

Forecast future income based on historical data and market trends.

2. Control Your Costs:

Identify fixed and variable costs associated with your operations.

Implement costsaving measures without compromising quality or efficiency.

3. Invest Strategically:

Allocate funds towards investments that offer the highest return on investment (ROI) and align with your business objectives.

Balance shortterm expenditures with longterm investments in innovation and growth.

4. Prepare for Contingencies:

Set aside funds for unexpected expenses or downturns in the market.

Establish an emergency fund to cushion your business against unforeseen challenges.

Additional Tips:

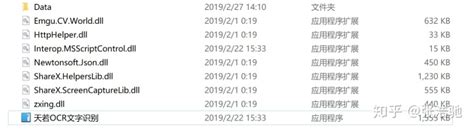

1. Embrace Technology:

Utilize budgeting apps and software to streamline the budgeting process and gain insights into your finances.

Leverage automation for bill payments and savings contributions to stay organized and disciplined.

2. Seek Professional Guidance:

Consider consulting with financial advisors or accountants for personalized advice tailored to your specific situation.

Stay informed about relevant tax laws and financial regulations to ensure compliance and optimize tax efficiency.

3. Cultivate Financial Discipline:

Practice frugality and avoid impulsive spending to stay within your budget.

Develop healthy financial habits like saving regularly and living below your means.

4. Celebrate Milestones:

Acknowledge and celebrate achievements along your financial journey, whether it's reaching a savings goal or paying off a debt.

Rewarding yourself periodically can help maintain motivation and sustain longterm financial discipline.

By following these budgeting principles and adapting them to your unique circumstances, you can gain better control over your finances, reduce stress, and work towards a more secure financial future. Remember, effective budgeting is not just about restricting spending; it's about making conscious choices that align with your values and goals.

评论